Canadian Investor Protection Fund

Investment Advisors

Investment Advisors

Many investors are unaware of the significant benefits of CIPF Coverage when a member firm fails.

Do you need IIROC Compliance Continuing Education (CE) Credits?

To help individuals employed by investment dealers learn more about CIPF, CIPF has developed the following webcasts, which qualifies for Compliance CE Credits:

- “Overview of Canadian Investor Protection Fund (CIPF)”: This webcast includes an interview with Rozanne Reszel, former President and CEO of CIPF, reviewing key questions about CIPF. This webcast is IIROC accredited and qualifies for 0.5 hours of Compliance CE credits. To register click here.

- “CIPF and CDIC: Coverage and Disclosure”: This webcast provide an overview of CIPF and CDIC. This webcast is IIROC accredited and qualifies for 1.0 hours of Compliance CE credits. To register click here.

CIPF Coverage

For detailed information regarding how our coverage works, you can also refer to these links: FAQs and CIPF Coverage.

CIPF has also launched the CIPF Advisor Series. This Resource Centre provides online materials to educate and inform advisors about CIPF’s role in the Canadian financial system.

Allocation of Losses to Customers

CIPF's coverage is determined after all available assets of the insolvent member firm are returned to customers by a trustee/receiver. For bankruptcies of a member firm administered under Part XII of the Bankruptcy and Insolvency Act (Canada), the process of returning all available assets of the member firm to customers is generally done by a trustee using the 4-steps outlined below.

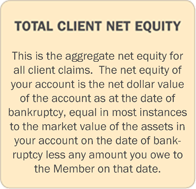

- At the date of insolvency, CIPF or the trustee/receiver will determine the TOTAL CLIENT NET EQUITY, and the size of the CUSTOMER POOL.

and

and

- CIPF/trustee will then determine EITHER:

OR

- CIPF/trustee will calculate the SHORTFALL, if there is one, as:

SHORTFALL = TOTAL CLIENT EQUITY less CUSTOMER POOL CIPF/trustee will allocate the SHORTFALL to each customer in proportion to their claim for net equity.

HERE IS AN EXAMPLE:

CIPF/trustee determines the following:

TOTAL CLIENT NET EQUITY $2.0 BILLION

CUSTOMER POOL $1.9 BILLION

SHORTFALL $100 MILLION or 5% (100 million / $2 billion)

CLIENT 1 HAS CLIENT NET EQUITY OF $2 MILLION:

LOSS ALLOCATED = $100,000 (5% OF $2 MILLION)

CIPF COVERAGE = $1 MILLION

LOSS TO CUSTOMER = NIL

CLIENT 2 HAS CLIENT NET EQUITY OF $20 MILLION:

LOSS ALLOCATED = $1,000,000 (5% OF $20 MILLION)

CIPF COVERAGE = $1 MILLION

LOSS TO CUSTOMER = NIL

CLIENT 3 HAS CLIENT NET EQUITY OF $25 MILLION:

LOSS ALLOCATED = $1,250,000 (5% OF $25 MILLION)

CIPF COVERAGE= $1 MILLION

LOSS TO CUSTOMER NOT COVERED BY CIPF= $250,000This example is for illustrative purposes and each insolvency can produce different results.

For more information, please refer to the CIPF Coverage Policy.